Company: Factor

About: Factor is an AI-powered, API-driven platform that enables energy retailers to grow their margins through intelligent and dynamic pricing for a rapidly changing energy world.

Stage: Pre-seed

Location: New Zealand

Leadership: Jessica Venning-Bryan, Simon Pohlen

Co-investors: Icehouse Ventures, Func Ventures, Flying Fox Ventures, Black Nova Capital, Motion Capital, AngelHQ, K1W1

Fund: I

Let’s talk about the energy grid

There are basically two ways to look at this; the simple way and the complex way. Now, this obviously depends on how you interact with the grid – you could be the consumer (end the user) or the energy retailer.

If you’re someone who generally pays for their energy bill on a regular basis (usually monthly or quarterly) to your electricity retailer, then you’re in the simple camp. In exchange for payment, you’re given access to a supply of power to your home and all the appliances connected to it – this could be your television, your stove, washer and dryer, computer, and even your electric car. It’s simple because the grid has been abstracted away from you. In other words, you don’t care about where the power is coming from. All of the electrical wiring and delivery systems to get the power to your house happens under the hood. Heck, you can even switch energy retailers seamlessly with very little impact to your daily routine.

However, if you’re on the other side: the retailer – those who buy electricity at a wholesale price from the generators and sell it to customers, handling billing and customer service, it means you’re on the complex side. Firstly, you have to deal with the fact that your customers no longer have a single connection with predictable usage. They might have solar panels, battery packs and EVs connected to their home. This can get more sophisticated if you have commercial customers operating a building, a warehouse and even a factory. To add another layer: wholesale and network pricing change during the day, as demand fluctuates. You can see this fluctuation below in the visual for energy usages (System Load) throughout the day, which more often than not resembles that of a duck.

So if you’re a retailer, you’re probably running legacy systems, designed for an older era, and can’t cope with the complexity – this then leads to a customer operations team on the retailer side that's overwhelmed and inefficient. Finally, it’s so much easier now for consumers to switch retailers, so customer churn and retention is a real thing, especially when it comes to affordability.

I think we can all agree that retailers have it rough. But now, we’re slowly seeing it spill over into customer land and it’s becoming a huge problem for both sides.

This is where something has to change.

But first, let’s talk about why the grid needs changing in the first place. It’s not just about outdated systems…

The Old Reality vs. The New World

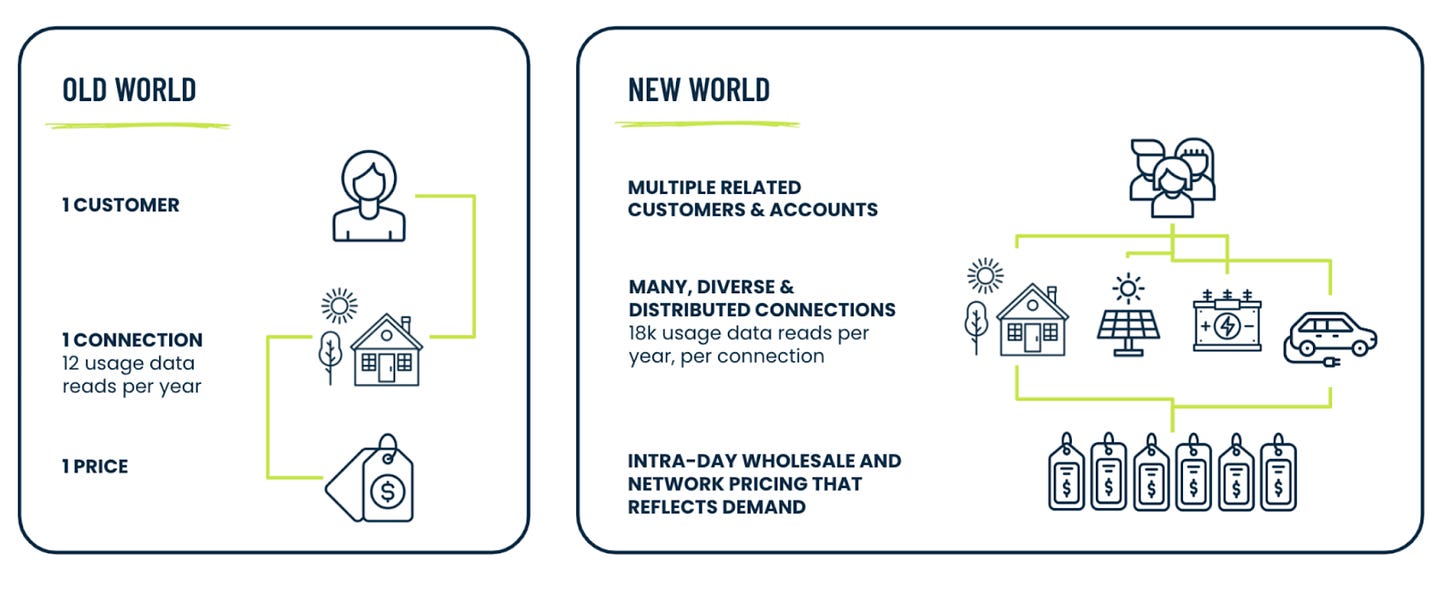

Traditionally, the energy retailers had it pretty easy. Each customer they worked with had one connection, and pricing was more or less flat, and didn’t really change. They collected usage data monthly, and their systems were built to handle this simplicity. Also, the market was predictable – and yes, there’s an actual energy market where these retailers would buy and sell electricity at particular prices.

In Australia we have the National Electricity Market (NEM) managed by the Australian Energy Market Operator (AEMO).

In the United States, the market is on the State level. For California, it’s the California ISO that operates the wholesale energy market for the State.

But things have changed over the years. The rise in renewable energy, distributed energy sources, and smart grids have created a new reality. Customers now have multiple diverse connections, and data volumes have skyrocketed. Pricing is now dynamic, driven by real-time market conditions, which adds yet another layer of complexity.

The visual below shows how the grid has become much more sophisticated with the inclusion of these distributed energy sources, microgrids and standalone power systems.

And let’s not forget the other elephant in the room: the rising demand for energy. The graph below from McKinsey clearly shows the projected uptick for the need of power generation over the next few decades. This will be driven not only by growing population bases, but also growing AI infrastructure and data centers that will require such power.

We’re also seeing an increasing trend in the number of renewable energy sources coming online. This will further add to the complexity of the grid, especially with variable supply and pricing as said sources are highly dependent on weather factors.

So all the legacy systems, which had a 1:1:1 model (one customer, one connection, one price), are now ill-equipped for this “many:many:many” environment. The result is an energy sector struggling to adapt, with retailers caught in a cycle of inefficiency and frustration.

Ultimately if this inefficiency and problem continues to persist, both sides of the market will experience problems. Retailers will continue to struggle adapting to changing prices in real-time, thin margins, and being overwhelmed with inefficient internal projects and dealing with more and more energy sources connected to the grid. This problem needs to be resolved rapidly and is highly consequential in ensuring the retailers continue to operate and minimize cost pressures as much as possible. Similarly, at the same time, the end users (like you and me) will also suffer because we most likely are overpaying for our energy when we know there's a better solution out there.

Enter Factor

Factor is trying to solve this very problem.

But before we go into the deep end on this, I wanted to spend a quick moment to explain how the electricity grid works from producer all the way to the consumer.

The above visual should help. It’s pretty straightforward from the supplier to the retailer, but it’s between the retailer and the customer where this can get hairy. So, everything to do with metering, billing/pricing between the retailer and home/business is where Factor sits.

Factor is basically building a platform that is purpose-built for the modern energy sector. They do this by ingesting and normalizing disparate and fragmented operational data – meters, EVs, solar panels, and more using a proprietary and highly abstracted data model. This model is designed to be market-agnostic, scalable and future-proof, capable of handling all of the data that make up the modern day energy grid.

Factor seamlessly integrates with existing (and legacy) software stacks via APIs which allow retailers to add data sets incrementally without costly implementation. They can start small, see results quickly, and then scale as needed.

What sets Factor apart is its novel use of AI to enhance data for intelligent forecasting, dynamic pricing and streamlining the billing process. This means that energy retailers can automate data-heavy tasks that bog down their team, potentially saving millions of dollars. It also means improving their margins through better forecasting and pricing strategies.

The bottom line is that Factor’s platform isn’t just a tool, it’s a strategic asset that empowers retailers to compete in a rapidly evolving market.

A Real World Example

To better understand how this could work, let’s illustrate this with an example.

Imagine you’re an energy retailer. Your customers range from traditional households to prosumers (another way to say those that consume and also produce power) with solar panels, batteries, and EVs.

Today is a sunny day and solar is flooding the grid. This oversupply of solar power results in a fall in wholesale prices, let’s say $20/MWh (Megawatt-Hour) from $50. But clouds are coming in tomorrow, and low wind tonight could push prices to $100/MWh. As a retailer you need to forecast these shifts, procure energy wisely, and price competitively. If your forecasts are off, then it can result in overbuying more energy than required.

More importantly, it becomes more complicated with renewables, especially wind and solar, the supply is variable. Solar surges during the day but fades by evening when ACs and EVs kick in. Decentralization adds another layer. Prosumers can export surplus solar while consuming variably. EVs also spike demand unpredictably.

So with all of this, pricing fluctuates dramatically throughout the day. As an end consumer, your daytime rate is 10c/kWh (kilowatt-hour), but evenings hit 30 cents. This could result where non-prosumers (those that just purely consume) can face higher rates as grid costs shift, raising fairness issues.

This is why platforms from Factor changes everything. It normalizes, meter, weather, and EV data, streamlining all the data points. Then using AI, they can forecast demand and supply with better accuracy. Dynamic pricing rates is now more aligned with market swings, which can help lift up margins and make it more affordable end consumer like you and me.

It’s All About Timing

We’ve now seen how the energy sector is at a crossroads. Trends like decarbonization, decentralization, and digitization are changing how energy is produced, distributed, and consumed.

It’s becoming clear that retailers need tools that can handle this complexity while enabling continual innovation and profitability. This would not only help them but the benefits would also be passed down to the consumers and their pockets.

By being able to provide accurate forecasting and real-time pricing, it allows retailers to optimize margins, design competitive products and even meet climate mandates. For example, retailers can use dynamic pricing to incentivize customers to ghost usage to off-peak times, balancing the grid and reducing costs.

The solution is pretty compelling because it tackles the root cause of the problem: data fragmentation. Rather than offering a point solution, Factor provides a service that integrates with multiple systems (e.g. CRM, billing, finance) and external data sources (e.g. weather, the energy and carbon markets etc.). This makes it super sticky and valuable, positioning them as a principal partner for energy retailers.

The Flywheel Effect

Flywheel effects are really important to us because it represents the ability of a product, company, person etc. to reach wider audiences at scale with minimal leverage. We truly believe you can create these effects with just about any venture, and Factor is no different.

We know that Factor will be able to help with cost savings, margin improvements, and ultimately happy customers and users. So, as more retailers adopt the service, Factor gains access to richer datasets, which should fuel its AI models, making the platform even more powerful. This enhanced platform then attracts more customers (because they can see the immediate benefits), creating a network effect.

Strategic partnerships then amplify this flywheel. By being able to integrate their pricing engine with other third-parties, it could lead to co-selling opportunities which could expand their reach even further. BUT, all of this really depends on being able to see not only the benefits, but gain the adoption it needs to create that momentum.

Why We’re Investing

Factor is doing cool stuff. But in most cases, it’s still not enough for us.

Led by Jessica and Simon, the founders are something special – they have a decade of experience in the energy sector, having helped build and scale previous energy retailers (like Flick), their deep industry knowledge and track record gives us confidence in their ability to execute.

It’s clear that both of them truly understand the problem at hand and they’re driven by a clear purpose. We both appreciate that this isn’t just a local problem, but a global one because energy touches each and every one of us – you’re reading this on a device that needs to be charged and powered by electricity.

If you now combine everything which includes the founders, the problem, the opportunity and the solution: Factor is born.

However, we’re very mindful of the risks and challenges involved. The energy sector is conservative, and adoption rates are not as fast as other industries (for now). Additionally, competition from legacy vendors or new entrants could also pose challenges. But, despite these risks, we strongly believe in not only Factor’s first-mover advantage into this space, and robust technology, but also key insider knowledge embedded inside its experienced team which gives them a competitive edge.

A Vision for the Future

Factor is tackling a critical problem in the energy retail sector with a solution that is both innovative and timely. Their platform has the potential to redefine how retailers manage data, enabling efficiency, profitability, and sustainability. This is why we believe Factor’s experienced team, robust technology, and strategic partnerships position it for success.

If Factor succeeds, the future of energy retail could be transformative.

Imagine a world where your energy retailer operate with precision and agility. They can offer dynamic pricing that reflects real-time market conditions, encouraging customers to shift usage to off-peak times, thus balancing the grid and reducing costs.

Accurate forecasting will optimize their energy procurement, minimizing waste and supporting sustainability goals.

The broader impact? A smarter, more resilient energy grid where data drives decision-making at every level. This vision aligns with global trends toward cleaner, more efficient energy systems, making Factor’s mission both timely and impactful.

Visit Factor to learn more about what they’re building.

Metagrove Ventures is an early-stage investment venture capital firm, focused on supporting founders and companies who are building the future of industry by creating inflection points in the market.

👉 Interested to invest with us, please click here to register your interest or reach out directly to the leadership team

👉 Interested to pitch us, please go here to submit your application

👉 For any press or media inquiries, please reach out here